-

Functional Areas

- Principal Recipient Start-Up

-

Legal Framework

- Overview

- Project Document

-

The Grant Agreement

- UNDP-Global Fund Grant Regulations

- Grant Confirmation

- Grant Confirmation: Face Sheet

- Grant Confirmation: Conditions

- Grant Confirmation: Conditions Precedent (CP)

- Grant Confirmation: Special Conditions (SCs)

- Grant Confirmation: Schedule 1, Integrated Grant Description

- Grant Confirmation: Schedule 1, Performance Framework

- Grant Confirmation: Schedule 1, Summary Budget

- Implementation Letters and Performance Letters

- Agreements with Sub-recipients

- Agreements with Sub-sub-recipients

- Signing Legal Agreements and Requests for Disbursement

- Language of the Grant Agreement and other Legal Instruments

- Amending Legal Agreements

- Other Legal and Implementation Considerations

- Legal Framework for Other UNDP Support Roles

-

Health Product Management

- Overview - Health Product Management

- UNDP Quality Assurance Policy

- Product Selection

- Quantification and Forecasting

- Supply Planning of Health Products

-

Sourcing and regulatory aspects

- Global Health Procurement Center (GHPC)

- Development of List of Health Products

- Development of the Health Procurement Action Plan (HPAP)

- Health Procurement Architecture

- Local Procurement of health products

- Procurement of Pharmaceutical Products

- Procurement of non-pharmaceutical Health Products

- Other Elements of the UNDP Procurement Architecture

- Submission of GHPC CO Procurement Request Form

- Guidance on donations of health products

- International freight, transit requirements and use of INCOTERMS

- Inspection and Receipt

- Storage

- Inventory Management

- Distribution

- Quality monitoring of health products

- Waste management

- Rational use

- Pharmacovigilance

- Risk Management for PSM of health products

- Compliance with the Global Fund requirements

- UNDP Health PSM Roster

-

Financial Management

- Overview

- Grant-Making and Signing

- Grant Implementation

- Sub-recipient Management

- Grant Reporting

- Grant Closure

- CCM Funding

- Import duties and VAT / sales tax

-

Monitoring and Evaluation

- Overview

- Differentiation Approach

- Monitoring and Evaluation Components of Funding Request

- Monitoring and Evaluation Components of Grant Making

- M&E Components of Grant Implementation

- Sub-Recipient Management

- Grant Reporting

-

Capacity development and transition, strengthening systems for health

- Overview

- Interim Principal Recipient of Global Fund Grants

- A Strategic Approach to Capacity Development

- Resilience and Sustainability

- Legal and Policy Enabling Environment

- Functional Capacities

- Capacity Development and Transition

- Transition

- Capacity Development Objectives and Transition Milestones

- Capacity Development Results - Evidence From Country Experiences

- Capacity development and Transition Planning Process

- Capacity Development and Transition - Lessons Learned

-

Risk Management

- Overview

- Introduction to Risk Management

-

Risk Management in the Global Fund

- Global Fund Risk Management Framework

- Local Fund Agent

- Challenging Operating Environment (COE) Policy

- Additional Safeguard Policy

- Global Fund Risk Management Requirements for PRs

- Global Fund Risk Management Requirements During Funding Request

- Global Fund Review of Risk Management During Grant Implementation

- Risk management in UNDP

- Risk Management in UNDP-managed Global Fund projects

- UNDP Risk Management Process

- Risk management in crisis settings

- Audit and Investigations

- Human rights, key populations and gender

- Human resources

-

Grant closure

- Overview

- Terminology and Scenarios for Grant Closure Process

-

Steps of Grant Closure Process

- 1. Global Fund Notification Letter 'Guidance on Grant Closure'

- 2. Preparation and Submission of Grant Close-Out Plan and Budget

- 3. Global Fund Approval of Grant Close-Out Plan

- 4. Implementation of Close-Out Plan and Completion of Final Global Fund Requirements (Grant Closure Period)

- 5. Operational Closure of Project

- 6. Financial Closure of Project

- 7. Documentation of Grant Closure with Global Fund Grant Closure Letter

Budgeting for Principal Recipient Audit

The audits that are carried out by the Office of Audit and Investigations (OAI) cover only the Principal Recipient (PR) activities as managed by a given UNDP Country Office (CO).

Should a Country Office have a Financing Agreement (FA) to provide technical support to national partners then the activities will be included in the audit of the Country Office and not part of the UNDP PR OAI audit. Therefore, there should be no audit costs included in the programme budget for a FA.

Effective 19 September 2017, UNDP and the Global Fund agreed to a tailored audit cost recovery process, in alignment with OAI’s risk-based approach to audit, as formalized in the Framework Agreement.

The process agreed with the Global Fund is as follows:

-

Budgeting – COs managing Global Fund grants are advised to budget for the OAI audit costs as follows:

-

High risk countries should budget for the audit costs of US$85,000 once in two (2) years. For high risk countries the timing of the budget should take into account the date the last OAI audit report for Global Fund programmes was issued. For example, if a high risk country was last audited in 2023, they should make a provision for a budget in 2025.

-

Medium risk countries should budget audit costs of US$85,000 once in three to four (3-4) years.

-

Low risk countries should budget audit costs of US$85,000 once in four to five (4-5) years.

-

In all cases, should a country not be audited in a particular year, then they should re-phase the audit budget to the following year until an OAI audit takes place and payment is made.

-

The risk ratings per country are updated by OAI every year in Quarter 4.

- The risk ratings will be communicated by the UNDP Global Fund Partnership and Health Systems Team (GFPHST) to the concerned COs and RSC.

- New Countries should use the previous year’s country risk rating to guide them in terms of the frequency of the OAI audits and should budget accordingly.

- For countries with more than one grant agreement the costs should be apportioned across the respective grant budgets (including C19RM), based on the total signed grant amounts.

- The audit costs are planned and budgeted under the account for “Professional Services” (74100).

- In the event there is an ‘unsatisfactory’ OAI audit rating, there will be a follow-up audit in the subsequent year as per UNDP guidelines. The CO or RSC should, therefore, request a budget reallocation to cover the costs of the follow-up audit.

- In Quarter 1 of the last year of the Implementation Period, UNDP will review the utilization of the audit costs and agree with the Global Fund on reprogramming of the savings, if any.

- For the active grants that do not have a budget line for OAI audits, COs or RSCs shall submit a request to the Global Fund for the budget reallocation of savings to include the audit costs in the respective grant budgets and the cash forecast for the annual Disbursement Request.

-

- OAI’s annual Global Fund audit plan – In December of each year, the GFPHST will share with the Global Fund and the COs, the OAI annual audit plan for the subsequent year and a proposal for the distribution of audit costs for the respective countries. For all grants selected for audit the CO should include audit costs in the cash forecast for the annual Disbursement Request.

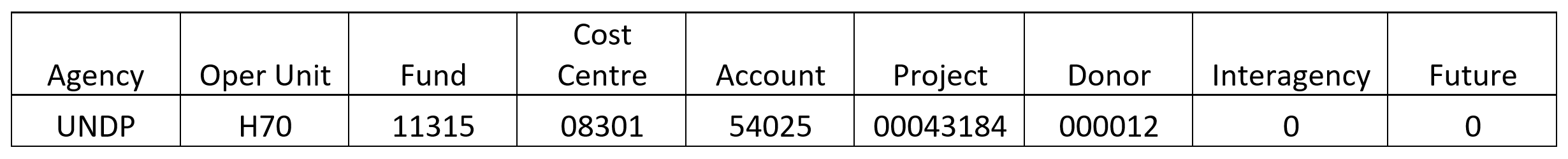

- Upon the issuance of a draft audit report by OAI, the US$85,000 for audit costs will be charged to the respective grants through a Zero Dollar Invoice (ZDI) (expense account 74110 “Audit fees” with the full COA in the GL and PPM segments), with a prorating of the cost (based on the signed amounts of active grants (including C19RM) for countries with more than one grant. The audit fees collected should be credited to the UNDP Global Fund Partnership and Health Systems Team (GFPHST) Income Account 54025 (Reimbursement for Management Services) with COA in the GL segment only as follows.

Additional guidance to support this area of work are also available through resources listed below: